#3 Serving you, not Business Partners

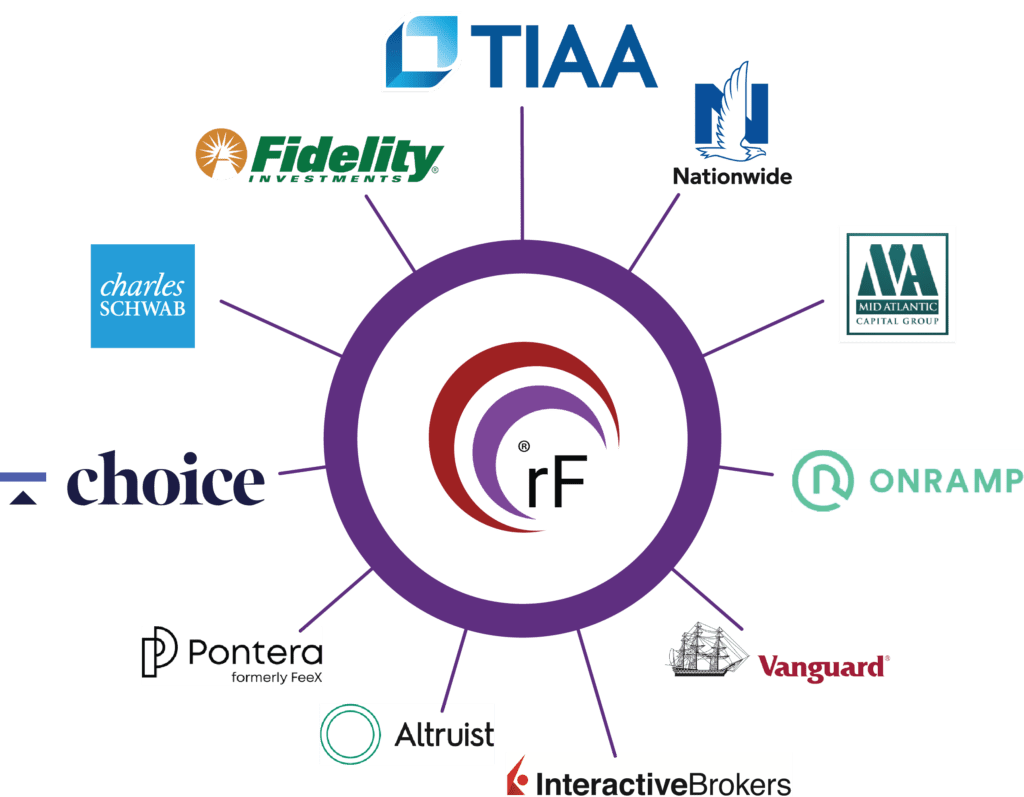

We pride ourselves on our multitude of different custodians you can choose from, unlike the typical firm which has one. You can add us as Limited Power of Attorney (LPOA) on your existing accounts or choose to start new accounts with any of our custodians, or multiple of them if you choose.

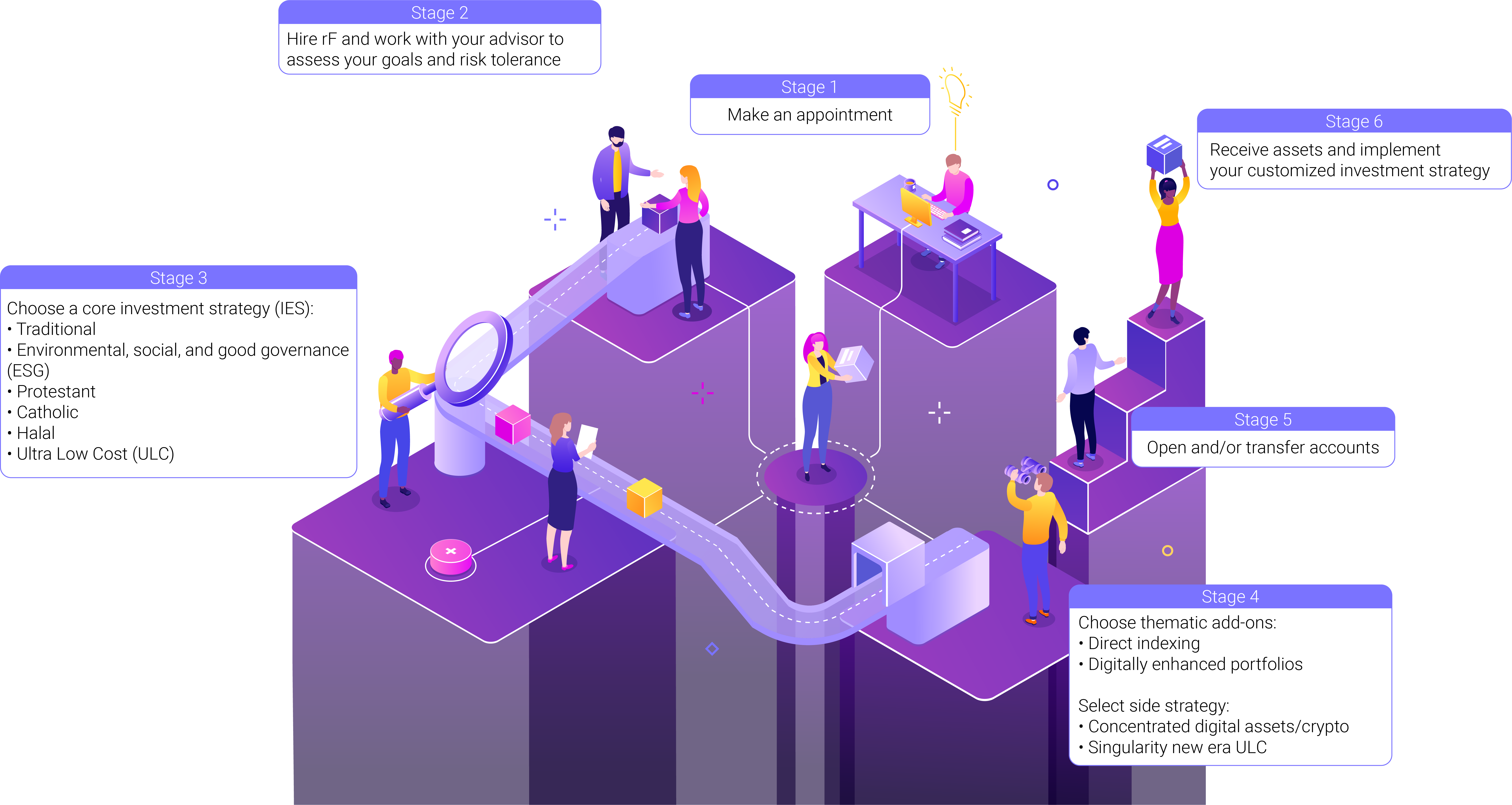

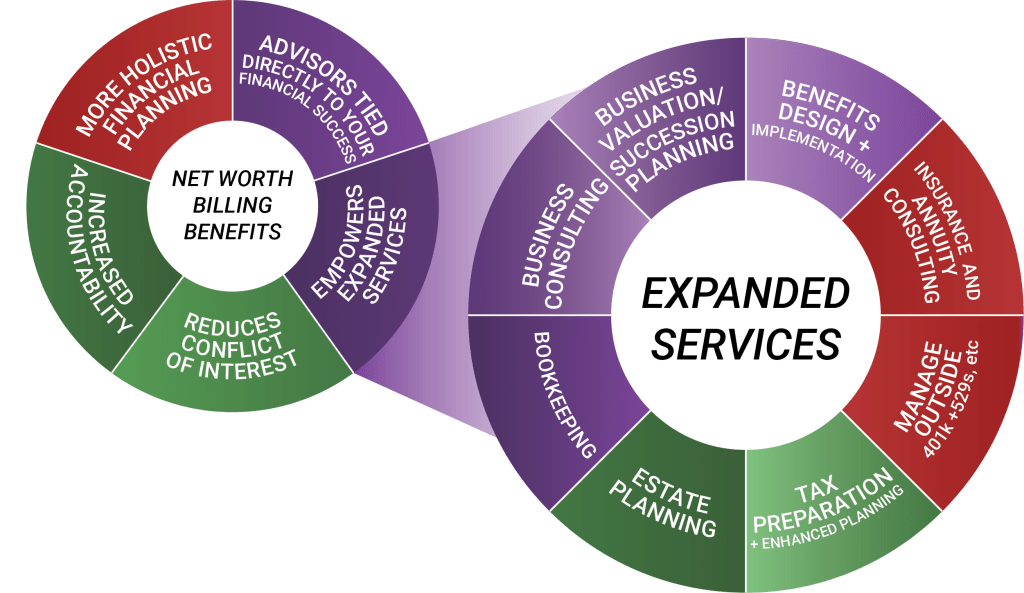

We believe in the power of strategic partnerships. We tirelessly seek out a diverse group of good investment partners and vendors in the industry, leveraging their expertise in different areas and services to benefit our clients. Our unique approach involves fostering healthy competition among these partners, pushing them to deliver greater value and pricing advantages that even larger firms often fail to secure. By combining our deep industry knowledge with these carefully selected partnerships, we create a seamless and rewarding experience for our clients, offering them access to more opportunities and strive to deliver better financial outcomes. Experience the difference of our client-centric approach, where we continually push our existing partners and strive to find new partners that drive more value and benefits to our clients which is at the heart of everything we do.