rebel Financial is a Registered Investment Advisor that provides retirement planning, estate planning, financial planning, and investment management services to individual and institutional clients. To get a more detailed description of the company, its management, and practices, view our (form ADV, Part2A) and Disclosures.

Fiduciary & Fee-Only Financial Advisors and Planners

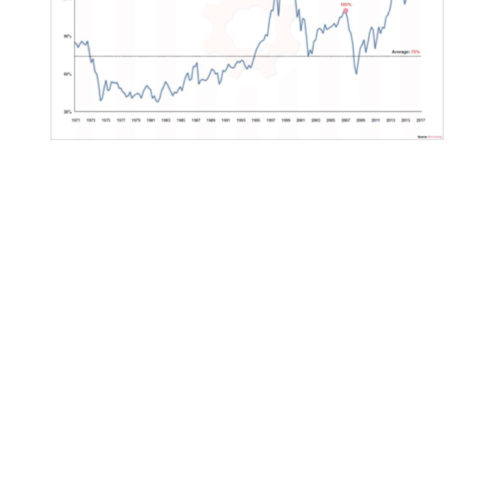

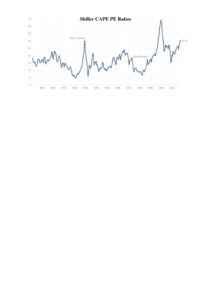

One of the oddities of a significant bull market—and this one we’re in today qualifies, as the second-longest in modern American history—is that they tend to go on longer than you might expect from the pure market fundamentals. The last leg of a bull market tends to be driven by psychology; people have recently experienced an up market, and so they tend to expect more of the same. They buy at prices they would never consider buying at when the markets have experienced a downturn, driving prices ever higher without regard to the price. As a result, the long tail of the bull market will also see some of the greatest, fastest increases.

One of the oddities of a significant bull market—and this one we’re in today qualifies, as the second-longest in modern American history—is that they tend to go on longer than you might expect from the pure market fundamentals. The last leg of a bull market tends to be driven by psychology; people have recently experienced an up market, and so they tend to expect more of the same. They buy at prices they would never consider buying at when the markets have experienced a downturn, driving prices ever higher without regard to the price. As a result, the long tail of the bull market will also see some of the greatest, fastest increases. The key point to remember is that investment markets are, by their nature,

The key point to remember is that investment markets are, by their nature,