The Growth Spike

The Growth Spike

Recent reports about the U.S. economy were a case of good news and bad news. The good news is that, in the second three months of the year, the U.S. economy grew at an estimated 4.1%—better than the 2.2% growth posted during 2018’s first quarter. The 4.1% figure is subject to revision as economists refine the numbers, but a 4% growth rate, if sustained through a period of years, would greatly bolster the wealth of all Americans.

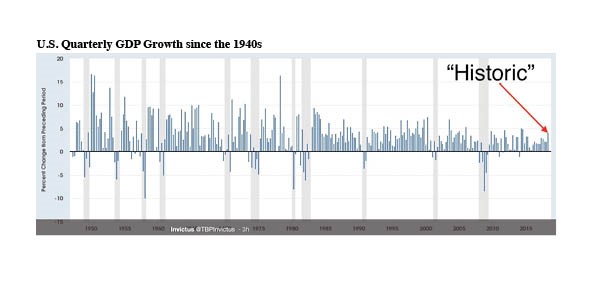

The bad news is that the economy will almost certainly not sustain this growth rate. And despite what you are hearing from political pundits, there is also nothing remarkable about a single quarter’s 4.1% GDP increase. As you can see from the chart, what has been labeled “historic” is actually pretty ordinary over the long term. The economy exceeded last quarter’s level four times during the Obama presidency, in 2009, 2011 and twice in 2014. 4.1% growth would have been considered alarmingly slow during the Reagan presidency.

Why can’t we sustain even this ordinary level of GDP growth? Economists have noted that this spike in economic activity was not entirely unexpected, and is the result of a number of one-off events. You might remember that Congress passed a significant corporate tax cut last. year, which kicks in at an unusual time: toward the end of a very long economic expansion, with consistently falling unemployment and rising home values. The U.S. economy just entered its tenth consecutive year of growth. Typically, Congress will pass a stimulus package to bail the country out of recession. One economist described the second quarter as an economy on a “sugar high.” If you have ever had small children, you know how those often end.

In addition, the quarter was aided (predictably) by foreign companies stockpiling U.S. goods before the threatened tariffs disrupt the flow of products across borders—temporarily boosting U.S. exports.

Long-term, the GDP of any country is determined by the growth in the number of workers and the rising productivity of those workers as they labor at their desks and on the factory floor. Neither of those factors are growing at anywhere near a 4% rate currently, which suggests that next quarter will see a return to the average 2-2.5% rate that we’ve experienced since 2009. That, in turn, may explain why the U.S. stock indices actually fell on the day of the “historic” GDP announcement. Savvy investors know better than to project one quarter’s results forward indefinitely into the future.

Sources:

https://www.yahoo.com/finance/news/ap-fact-check-trump-falsely-044729698.html

https://www.cbsnews.com/news/us-gdp-growth-touted-as-historic-by-trump-is-totally-standard/

https://www.cnbc.com/2018/07/27/us-gdp-q2-2018.html

This article was written for information purposes only and its content should not be construed by any consumer and/or prospective client as rebel Financial’s solicitation to affect, or attempt to affect transactions in securities, or the rendering of personalized investment advice for compensation. No client or prospective client should assume that any such discussion serves as the receipt of, or a substitute for, personalized advice from rebel Financial, or from any other investment professional. See our disclosures page for more information.