Purchasing a Home For Your Family Member with Special Needs

As their child with a disability reaches adulthood, families give increased thought to their child’s housing needs. Many families want to promote the maximum independence

As their child with a disability reaches adulthood, families give increased thought to their child’s housing needs. Many families want to promote the maximum independence

Since their inception, Roth accounts have been a great saving vehicle for families planning for their retirement. This saving tool has also been a nice

Estate planning can be complicated. To simplify the process, here are 9 questions that should be on your estate management checklist to ease the process for

The 2015 Obergefell v. Hodges Supreme Court decision streamlined tax and estate strategizing for married LGBTQ+ couples. If you are filing a joint tax return for

A living trust primer is a popular consideration in many estate strategy conversations, but its appropriateness will depend upon your individual needs and objectives. A

A friend or relative asks you to be their executor of estate. What, exactly, are they asking you to do? An article on the NerdWallet website

Who is John Lubinsky? John Lubinsky, the founder of The Lubinsky Team Remax Affiliate, has been rebel Financial’s golf event co-sponsor for the past three

How does it work? “A life insurance policy is a contract with an insurance company. The company provides a lump-sum payment, known as a death

You may have read that there has been a drop in new home sales—down 13% inSeptember compared to the previous September—and that, combined with the

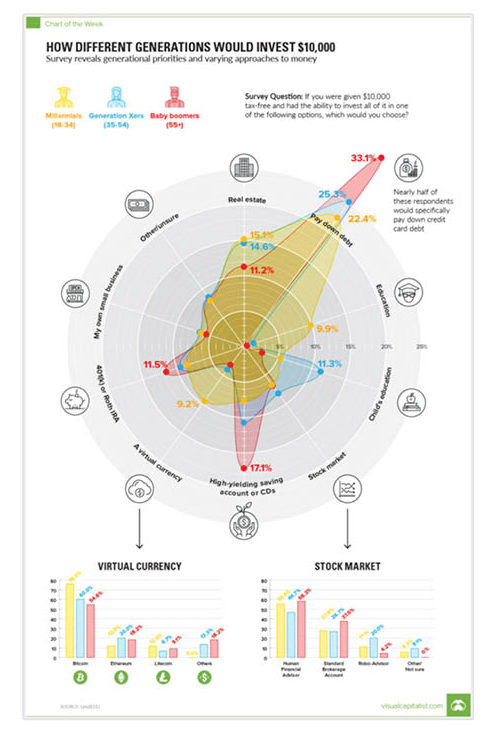

GENERATIONAL FINANCIAL DIVIDE If some random person off the street handed you $10,000 in cash, no strings attached, and would pay the taxes on this

rebel Financial is a Registered Investment Advisor that provides retirement planning, estate planning, financial planning, and investment management services to individual and institutional clients. To get a more detailed description of the company, its management, and practices, view our (form ADV, Part2A) and Disclosures.

Fiduciary & Fee-Only Financial Advisors and Planners

All websites created by the rF marketing team