Retirement Planning And The Differences You Could Face

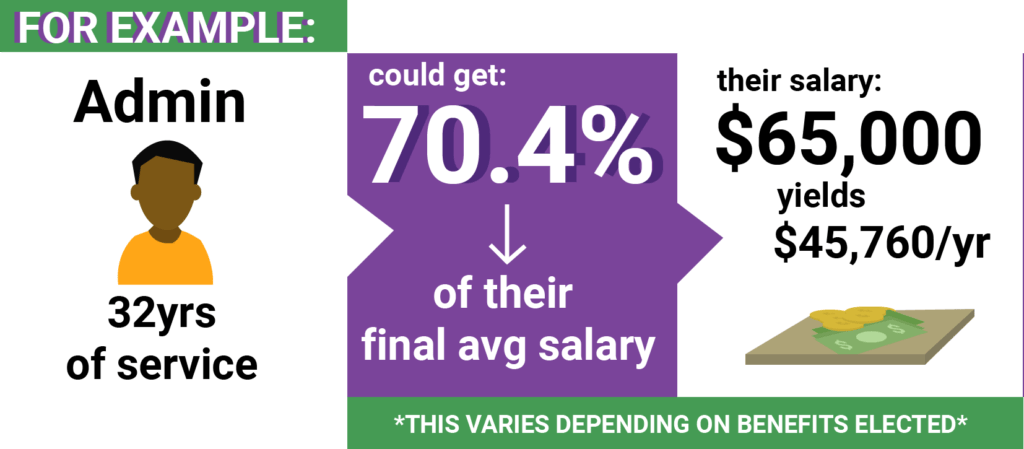

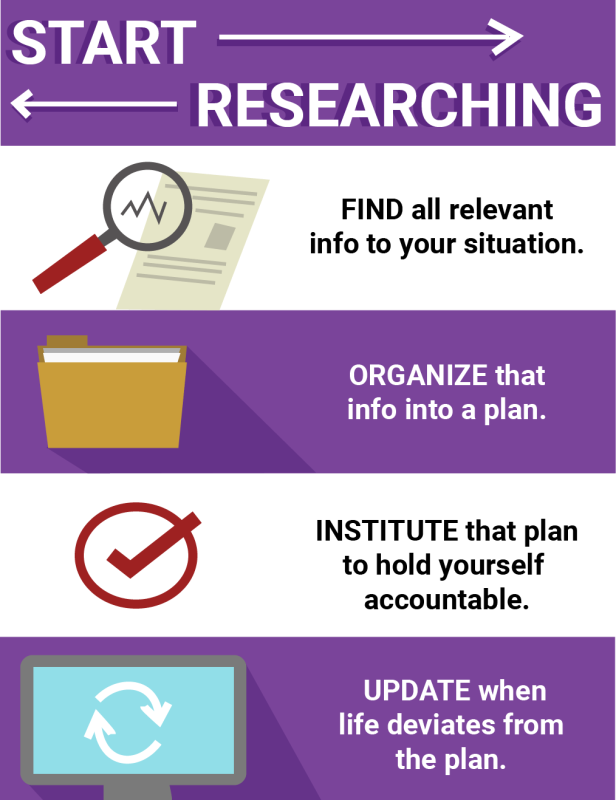

Retirement planning can be difficult regardless of your age, employment history, and preferences. However, when you throw in the added complexity of the many choices that OPERS offers you, it can be difficult to know what to do. Unlike most people that will just file for their Social Security check when they retire, you will have to make many decisions such as survivorship benefits/percentages, beneficiaries, PLOP, healthcare choices. All of these must be weighed in collusion with your other accrued benefits, savings, retirement objectives, and estate plan.