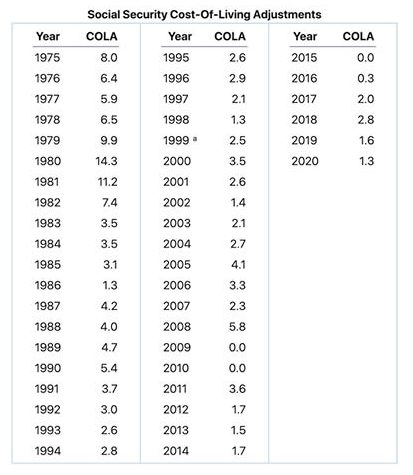

Every year since 1975, the Social Security Administration has automatically adjusted its benefit payments upward to account for inflation; the goal is for the payments to keep pace with the cost of living that recipients are experiencing. For the past decade, these inflation adjustments have been pretty modest, as you can see in the chart. In 2009, 2010 and 2015, there was no increase, and many of the other raises were 2% or less.